-

1OT

OnTrajectory

This product hasn't been added to SaaSHub yetAccountMe describes itself as just like corporate accounting, with a few twists. Specifically, tracking your expenses in a personal budget needs a little more nuance than traditional GAAP accounting allows. So AccountMe divides your expenses into three categories: Necessary Fixed Expenses, Necessary Variable Expenses, and Discretionary Expenses.

-

Take control of your money now with Personal Capital. Manage assets and investments, get objective advice and strategies, all in one place.

One way to describe Personal Capital’s budgeting software is an “account aggregator.” This program allows you to track and understand every single penny in all of your financial accounts. Once you link up all of your various accounts, including your bank accounts, investments, mortgage, credit cards, and any other accounts, Personal Capital summarizes your finances and offers you basic investment guidance. More info…show

#Personal Finance #Financial Planner #Accounting 2 social mentions

-

Personal loans to help manage high-interest credit card debt

After you download the app onto your Android, iPhone, or other Apple device, you then connect your accounts to Clarity. The program analyzes your spending data before making suggestions to you on how you can optimize and save your money. Clarity Money is able to do this through their Bill Cancellation service, which identifies wasteful recurring charges and will cancel those services for you.

#Personal Finance #Financial Planner #Budgeting

-

Free personal finance software to assist you to manage your money, financial planning, and budget planning tools. Achieve your financial goals with Mint.

When you sign up with Mint, you provide the program with all of your financial accounts, including bank accounts, investments, retirement funds, credit cards, 529 accounts, and even real estate purchases. Mint allows you to see all of your financial information in a single dashboard, which also calculates your net worth. More info…show

#Personal Finance #Financial Planner #Budgeting 80 social mentions

-

Products - Clarity: Clarity is advanced Chromatography Data Station (CDS) with optional software modules for data acquisition, processing and instrument control. Its

After you download the app onto your Android, iPhone, or other Apple device, you then connect your accounts to Clarity. The program analyzes your spending data before making suggestions to you on how you can optimize and save your money. Clarity Money is able to do this through their Bill Cancellation service, which identifies wasteful recurring charges and will cancel those services for you.

#Security #Web Analytics #Web Application Security

-

Stay in control of your monthly cash flows, budgets, and expenditures. Quicken provides a navigable interface where you can organize your debit, credit, and savings, and build good habits accordingly.

Quicken is the great-granddaddy of personal finance software–it was first introduced back in 1983. Though Quicken was owned by Intuit until a few years ago, the current version, Quicken 2019, has all the familiar tools and offerings that anyone who cut their teeth on the Intuit versions are used to. More info…show

#Personal Finance #Financial Planner #Accounting 12 social mentions

-

Personal finance for couples

You can link most financial accounts to Zeta securely, including investment accounts. This allows you to see a full picture of your financial health in one place. Zeta also helps couples that share financial responsibilities but don’t have shared accounts. It allows you to split transactions, like a rent payment. You also can control what your partner sees if you have separate accounts. Other features include:

#Personal Finance #Financial Planner #Online Payments 2 social mentions

-

Smart budgeting & personal finance software

Pocketsmith is a calendar-based financial planner that allows you to look at your upcoming spending, set goals, track your expenses, and pull reports that show you exactly where you stand financially. It will help you maintain a focus on cash flow forecasts while setting goals that help you reach your savings and debt reduction goals. You can add actual spending data from your bank account to help shine a light into areas you may be over-spending or under-budgeting.

#Personal Finance #Financial Planner #Budgeting 1 social mentions

-

9MP

MoneyPatrol

This product hasn't been added to SaaSHub yetAccountMe describes itself as just like corporate accounting, with a few twists. Specifically, tracking your expenses in a personal budget needs a little more nuance than traditional GAAP accounting allows. So AccountMe divides your expenses into three categories: Necessary Fixed Expenses, Necessary Variable Expenses, and Discretionary Expenses.

-

Personal home budget software built with Four Simple Rules to help you quickly gain control of your money, get out of debt, and reach your financial goals!

YNAB believes that in order to successfully budget, you need to be hands-on with your money. Until the version released in December 2015, users had to manually enter all transactions–although the program and its companion apps for iPhone, iPad, and Android devices made this very easy. This also means that YNAB is one of the few programs that easily allows users to track cash spending.

#Personal Finance #Financial Planner #Accounting 55 social mentions

-

Qube Money is the #1 new budgeting app on a mission to digitize cash envelopes! Create a budget in minutes and start spending with purpose. Download the app today and start organizing your finances.Pricing:

- Freemium

- Free Trial

- $8.0 / Monthly (Premium User)

Cons: The fact that you are unable to use your Qube Money debit card if you do not have your phone available could be problematic. Qube Money recommends taking a separate pay card to alleviate this concern.

#Personal Finance #Budgeting #Mobile Apps 11 social mentions

-

With all the financial issues affecting people in these difficult times, Mvelopes can help you get a full view of all your finances and help you get on top of them.

The basic Mvelopes program costs $4 per month or $40 per year if you pay all at once. The next tier is Mvelopes Plus, which costs $19 per month or $190 per year. This program offers everything in the Basic version, but also offers access to a debt reduction plan and guidance and a quarterly check-in from a personal finance trainer. The Mvelopes Complete version costs $59 per month, or $149 per quarter, or $549 per year. If you sign up for the Complete version, you get monthly one-on-one sessions with a personal finance trainer, a customized financial plan, and full access to all the budgeting tools on the platform.

#Personal Finance #Budgeting #Financial Planner

-

Budgeting and expense tracking app

Creating the budget is the easiest part. From there, it is up to you to input all of your transactions manually. (EveryDollar Plus, which costs $129 per year, will automatically import transactions for you.) There are both iPhone and Android apps available to make inputting transactions simple while you are out and about. One common complaint about EveryDollar is that it does not allow users to create recurring transactions, which can cause you more work as you try to reconcile your transactions with your budget.

#Personal Finance #Budgeting #Financial Planner 11 social mentions

-

14SP

SpendPal

This product hasn't been added to SaaSHub yetAccountMe describes itself as just like corporate accounting, with a few twists. Specifically, tracking your expenses in a personal budget needs a little more nuance than traditional GAAP accounting allows. So AccountMe divides your expenses into three categories: Necessary Fixed Expenses, Necessary Variable Expenses, and Discretionary Expenses.

-

15PM

Pluto Money

This product hasn't been added to SaaSHub yetAccountMe describes itself as just like corporate accounting, with a few twists. Specifically, tracking your expenses in a personal budget needs a little more nuance than traditional GAAP accounting allows. So AccountMe divides your expenses into three categories: Necessary Fixed Expenses, Necessary Variable Expenses, and Discretionary Expenses.

-

Spend Happier & Build Your Savings

Currently, Joy is only available for iPhone users but has a waitlist for anyone using Androids. Once you download Joy onto your iPhone, you will be prompted to answer a set of questions. These questions determine your personality type and your money philosophy in order to better understand you and to help you reach your financial goals. You are then paired with a money coach based on the answers you provided. Your money coach will help guide you to take control of your finances.

#Wedding #Health And Fitness #Wedding Organizer 34 social mentions

-

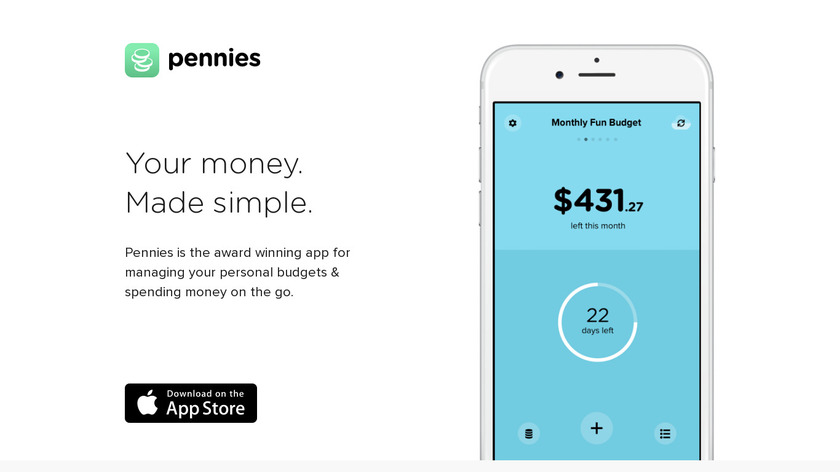

Incredibly simple personal budgeting app for iOS

Pennies is a very intuitive iPhone app that helps even the most absent-minded of spenders to stay on budget. Pennies allows you to set a number of budgets (such as monthly fun money, weekly food spending, and the like), with a start date, length of budget term, and the amount available to spend. Each time you make a purchase, you enter the amount into Pennies, which will show you the number of dollars and days remaining in that particular budget. More info…show

#Personal Finance #Financial Planner #Fintech

-

18AM

AccountMe

This product hasn't been added to SaaSHub yetAccountMe describes itself as just like corporate accounting, with a few twists. Specifically, tracking your expenses in a personal budget needs a little more nuance than traditional GAAP accounting allows. So AccountMe divides your expenses into three categories: Necessary Fixed Expenses, Necessary Variable Expenses, and Discretionary Expenses.

Discuss: The Best Personal Finance Budget Software with Apps (In 2020)

Related Posts

Best 9 Personal Finance Software For Windows 11, 10 Free PC, Surface Pro

techwibe.com // 4 months ago

Best personal finance software of 2024

techradar.com // 5 months ago

My favorite open source tools for personal finance

opensource.com // about 1 year ago

18 Best Free GnuCash Alternatives for Free Accounting

thegeekpage.com // over 1 year ago

6 Best Bill Splitting Apps for Hassle-Free Expense Sharing

how2shout.com // 10 months ago

12 Best Bill Splitting Apps in 2023

mobileappdaily.com // 7 months ago